How Am I Taxed?

Taxes confuse almost everyone.

I cannot tell you how often someone tries arguing with me about something tax related when they are entirely wrong. And to be fair, the tax code is long and confusing. To make matters even worse, for some reason, taxes are not actively taught to people.

This is exactly why most people do not understand:

How income is actually taxed

What marginal tax rates are

That not all capital gains are taxed as long term capital gains

That all investment accounts are not created equal

There’s a reason the tax code seems so mysterious to the majority of its would-be readers – it’s over 6,500 pages long, and when you add in the official cases and notations, it jumps to a nearly impossible 70,000. The good news is most taxpayers only need to concern themselves with a handful of topics.

So this week’s blog post is going to take a deep dive into everything you need to know about the stuff that is likely to affect you. We will talk:

Income Taxes

Capital Gains Taxes (short term and long term)

Tax Treatment of Various Investment Accounts

Let’s get started.

Income Taxes

We have a progressive tax system in the US, which taxes its taxpayers marginally. This means that as your income meets certain thresholds, your tax rate increases. This confuses a lot of people and leads them to believe that all their income gets taxed at a higher rate as they make more, but this is not true since taxes are calculated on a marginal basis. So what does marginal really mean? This means that large chunks of your income are subject to different rates. Think of it like you’re filling buckets. These buckets are different sizes and as they’re filled with income, the IRS assesses an updated tax to each bucket incrementally. I know, it’s still confusing.

Let’s look at the chart below to explain this better.

As you can see, the more you make, the higher marginal tax bracket you are in. But, not every dollar is taxed in that bracket.

Let’s say you are married and your taxable income is $250,000. Not all $250,000 would be taxed at 24%. Let’s apply our bucket analogy:

The first bucket is considered filled at $22,000 and would be taxed at 10% = $2,200.

The next bucket can hold $77,450 and would be taxed at 12% = $9,294

The next $101,300 would be taxed at 22% = $22,286

The remaining $59,250 would not completely fill the last bucket. It’s taxed at 24% = $14,220

Total tax = $48,000 ($2,200 + $9,294 + $22,286 + $14,220)

This person’s marginal tax would be 24% because every dollar earned moving forward would be taxed at 24% until they hit $364,201, which at that point, every additional dollar starts to be taxed at 32%.

Another term you need to understand is your effective tax rate. This is the percentage of tax you paid compared to your taxable income. You find it with simple division(total tax/taxable income). For this example it would be $48,000/$250,000 = 19.2%.

How Bonuses Are Taxed

Bonuses are taxed the exact same as any other income. People often mistake this and think that it is taxed higher, but they are simply mixing up the difference between what is taxed and what is withheld. Bonuses are withheld at 22% or the aggregate method where they combine the bonus and your monthly income and assume you are in a higher tax rate so they withhold more.

What you really need to take away from this is that bonuses are taxed the same as all other income.

Key takeaways on income tax:

Taxes are marginal meaning not every dollar is taxed at the same rate

Effective tax rate = the average amount of tax you pay on your income actually subject to tax

Bonuses are taxed at your marginal tax rate (but more or less may be withheld)

Capital Gains Taxes

Everything we talked about above is around taxes on income you earn. Capital gains taxes are taxes on the profits you make from the sale on an asset like a home, investment, etc.

The first consideration for calculating capital gains is how much you acquired an asset for – this is called cost basis. Now, this can get more complicated as you add various complexities to your transactions, but for this post, we’re going to keep it simple and stick to cost basis = what you originally paid for the investment. Anytime you have a sale that comes out positive, in excess of basis – a fancy way of saying profit, it is considered a taxable event.

To figure out how much you will be taxed depends on the time frame you held the investment for. If you held the investment for less than 1 year, you would be taxed at the short term capital gains rate which is the same as your marginal tax rate (discussed in the last section). If you hold for greater than a year, then you are taxed at long term capital gains rates which are more favorable.

Note: Retirement accounts do not have capital gains taxes.

Short Term Capitals Gains

Investments that are sold within 1 year are taxed at ordinary income rates like the first chart above. This means you will be taxed at 10% up to 37% depending on your income.

Let’s illustrate this using the example above with a married couple making $250k. If they bought an investment for $10,000 and sold for $20,000 within a year, then the $10,000 gain would be taxed at their marginal tax rate, 24%. Total federal tax = $10,000 x .24 = $2,400.

The higher the tax bracket you are in, the more favorable it is to hold investments for greater than a year. But… do not just hold investments because of taxes. You are risking market fluctuations that can easily offset the tax benefit.

It is also important to note that you may have state taxes on capital gains depending on the state you live in.

Long Term Capital Gains

Long term capital gains are from investments you hold for over a year. They typically come at a lower rate than short term capital gains rates. The tax rates are 0%, 15%, or 20%. But you also can get hit with Net Investment Tax (3.8%) once your income is over a certain threshold. The chart below shows the tax rates based on income for long term capital gains.

Let’s use the same example above to illustrate this. Married couple making $250,000 and they bought an investment for $10,000 and sold for $20,000 a year and a half later. Because they held for over a year, they get long term capital gains tax treatment which would be 15% for them. The tax due would be $10,000 x .15 = $1,500. This is $900 lower than with short term capital gains.

Net investment tax is hit at $250,000 for a couple that is married filing jointly. So this could end up applying to this family. But for this post’s purpose, we will keep it simple.

Key takeaways on capital gains tax:

Short term capital gains are taxed at income rates

Long term capital gains have favorable tax treatments: 0, 15, or 20%

Net investment tax is taxed at 3.8% and added on as you break through the income threshold.

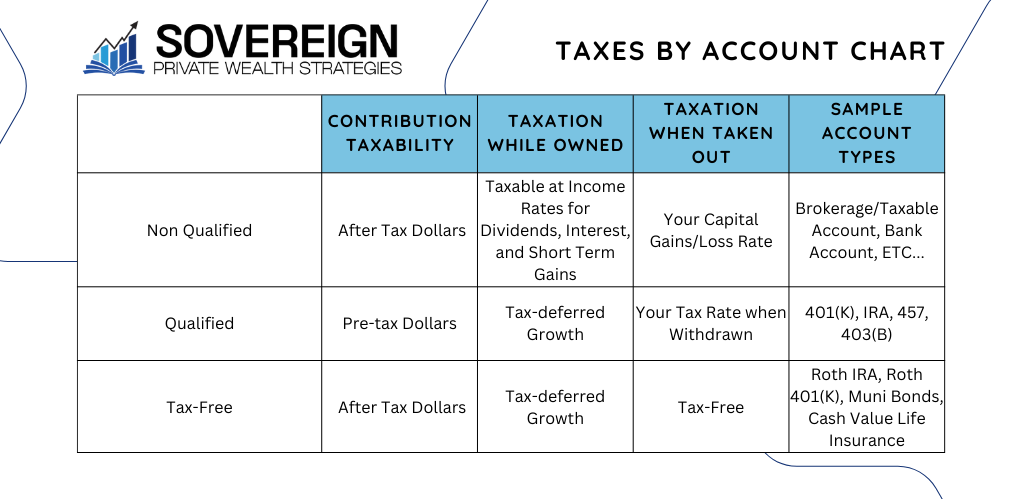

Tax Treatment For Each Type Of Investment Account

Key takeaways on taxes by investment account:

Roth dollars are put in after you have paid taxes, then they are never taxed again

With Traditional accounts (401(k), IRA, etc) money is put in pre-tax then gets taxed at income rates when withdrawn in retirement

With a Taxable (brokerage) account – money is put in post tax and then taxed at capital gains rates which we talked about above

Hopefully this post helps you understand how you are taxed a lot better. Remember, tax planning is one of the most important areas of personal financial planning that can really move the needle.

Disclaimer: None of this should be seen as advice. This is all for informational purposes. Consult your legal, tax , and financial team before making any changes to your financial plan.