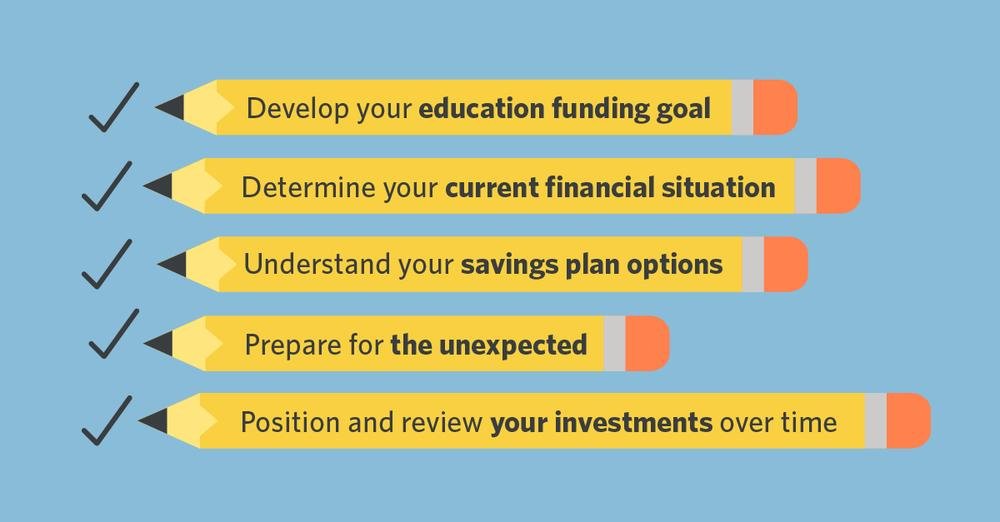

Education Savings Checklist

Whether you're a parent, grandparent or simply want to make a difference in a child's life, it's important to understand the investment and savings options that are available to you. This saving for education checklist can help you get started.

Plan for the Expected

Develop your Education Funding Goal.

Consider what type you expect your child, grandchild or loved one to attend: public, private or vocational, and if your goal is primarily for college or for pre-college education costs..

Estimate future costs. You don't have to know the exact amount - even an estimate can be helpful.

Set a goal based on the estimated costs and how much of that cost you wish to cover.

Determine Where You Are Today.

Work with your financial advisor to take stock of your current financial situation and needs.

Identify ways to increase your savings. For example, once you no longer have daycare expenses, invest that money in this goal.

Discuss balancing education goals with your other goals, such as retirement.

Understand Your Savings Plan Options.

Review various ways to save for education, including:

529 Savings Plans

Personal savings

Custodial accounts

Prepare for the Unexpected

Create an emergency cash fund to cover at least three to six months' worth of living expenses.

Discuss strategies to protect your family and finances from unpredictable risks.

Keep your beneficiary information up-to-date.

Position Your Portfolio for Both

Determine investment allocation

After understanding your goals, current situation, time frame and risk tolerance, your financial advisor can help you choose investments appropriate for you and adjust as these factors change. For example, you may be more growth-focused when your children are younger, but you may become more conservative as they approach their college years.

Review, review, review

Review your education savings strategy at least annually, including potential changes to:

Education costs and financial aid options

Your child's college choices

Your investment allocation and performance

Your other goals (and even the number of children you’re providing for)

Make adjustments, if necessary.