Saving for your child's college education

Opening an education savings account, saving early and saving often are ideal ways to earmark money for your child’s tuition costs.

A 529 Plan, or the variety of other available education savings accounts (ESAs), can offer tax benefits, too. Some families worry that saving for college may hurt their chances of receiving financial aid. In reality, 529 plans and many other education savings options are considered parent-owned assets, meaning only a small percentage of the savings (less than 6%) are reflected in the financial aid calculation. The key is to identify which account is right for you and when to start saving, while keeping your other financial goals on track.

How much should I save for my child’s college education?

Before diving into what college savings approach is best for you, think about what type of school you want to plan for (private, public, vocational, postgraduate), the associated costs (see the chart below) and how much you want to cover.

Will you pay for all your child’s college expenses? Half of everything? Tuition but not room and board? While there isn’t one right answer, you should decide what works best for your family’s personal and financial situation. Your financial advisor can help you determine how much college may cost, as well as how the savings may affect your other goals.

Source: College Board, Trends in College Pricing 2022, and Edward Jones estimates. Amounts represent one year of education expenses, including tuition and room and board for in-state public and four-year private universities. Community college does not include room and board. Assumes 4% annual inflation rate. Rounded to the nearest $500.Chart description

This graph illustrates the yearly cost of attendance for community college, public university, and private university for 2022-2023, as well as the forecasted cost in 10 years and 18 years, respectively.

• For community college, the blue bar indicates a cost of $4,000 for 2022-2023, the gold bar shows $5,500 per year in 10 years, and the orange bar shows $8,000 per year in 18 years.

• For a public university, the yearly cost comes to $23,500 for 2022-2023, $34,500 in 10 years, and $47,000 in 18 years.

• For a private university, the yearly cost comes to $53,500 for 2022-2023, $79,000 in 10 years, and $108,000 in 18 years.

If I don't fully fund my child’s college education, what are other ways to help pay for it?

There are many options for paying for college outside of savings, each with its own set of considerations. Outside of parent contributions and savings, the majority of education funding comes from scholarships, grants and loans. Student income and savings are also meaningful contributors to education funding, including through work-study programs.1

Scholarships: Scholarships are offered from a variety of sources and don’t have to be repaid. Many students will receive a partial scholarship. However, scholarships generally do not cover the full cost – or even most of the cost of college.2

Grants: Grants generally don’t need to be repaid. While scholarships are often merit-based, grants are more likely to be need-based.

Federal or private student loans: Loans must be repaid within a certain time frame and incur interest. Over 50% of bachelor’s degree recipients use this option3.

Work-study programs: These programs provide part-time jobs for undergraduate and graduate students to help pay for education expenses. How much your student receives in compensation depends on your school and your financial need.

We can show you different ways to save for education and will explain how different ways of investing and borrowing may affect your overall financial strategy.

When do I start a college savings fund for my child?

Once you have the basics down, we can talk about how much you need to save and work out a plan to help get you there. Keep in mind, time can be one of your biggest assets, so the earlier you begin saving, the better. Staying on track by earmarking a certain amount each month can make a big difference.

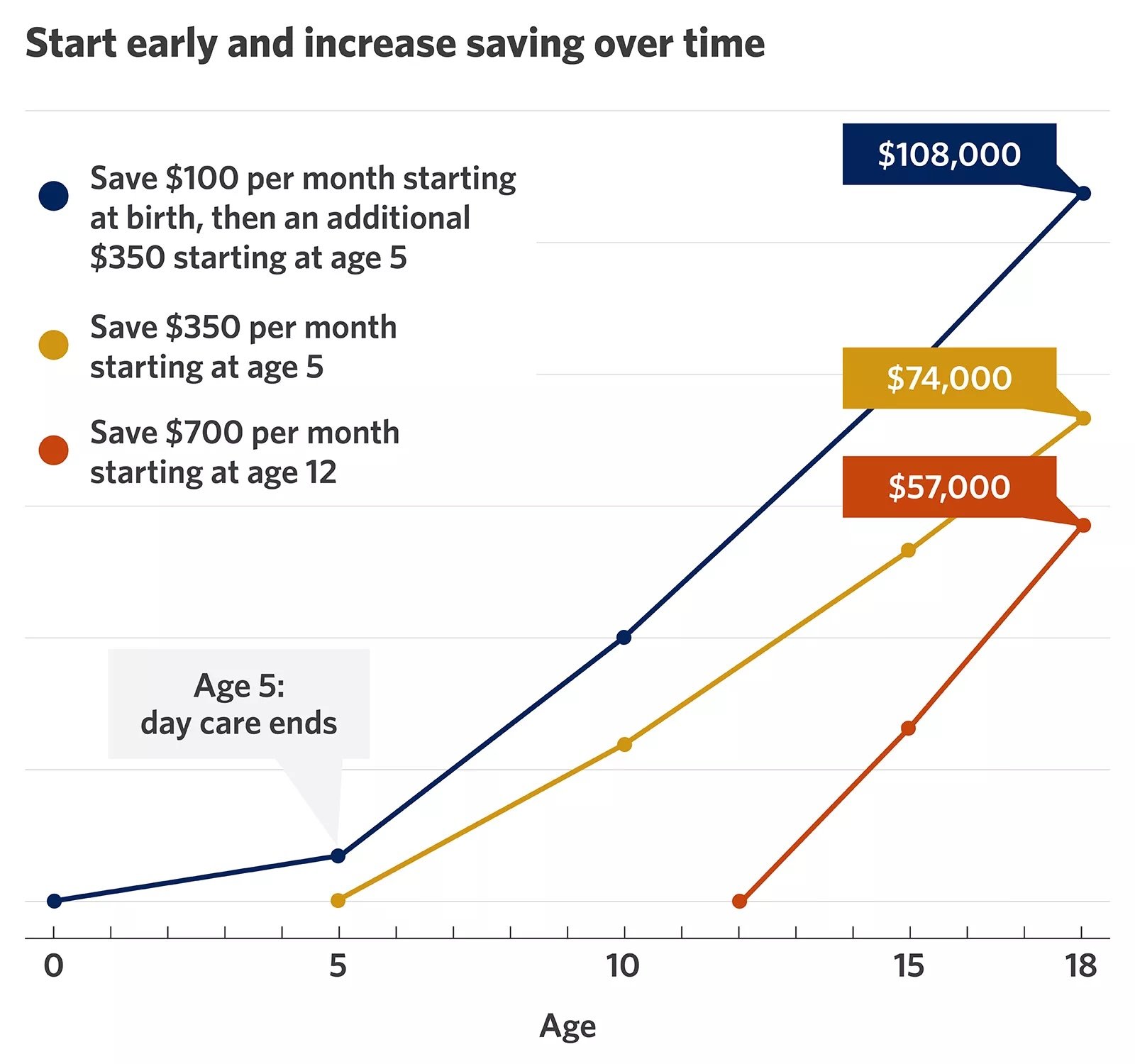

One college savings approach many families adopt is to invest a portion of the money that was previously dedicated to day care expenses into a college savings plan like a 529. This chart shows the differences among three savings strategies:

Calculations assume an annual rate of return of 5.5% through age 8, then 4.5% through age16, and then 3.5% through age 18. Numbers rounded to nearest thousand. This graph is for illustrative purposes only and does not represent any currently available investments.Chart description

This graph shows how both the amount you save and when you start saving make a real difference.

• The blue line shows you’ll accumulate $108,000 if you put aside $100 per month starting at your child’s birth through age 4, then save an additional $350 from childcare savings (for $450 total per month) from age 5 until 18.

• The gold line shows you’ll accumulate nearly $74,000 if you put aside a portion of previous childcare costs and save $350 per month starting at age 5 until age 18.

• The orange line shows you’ll accumulate $57,000 if you put aside $700 per month for a child from age 12 to age 18.

Where can I save for my child’s college education?

There are a variety of ways to save for higher education. Here are some account types to consider:

529 savings plan

Coverdell education savings account (ESA)

Savings bonds

Taxable investment accounts

Custodial accounts (UGMA and UTMA)

We can help determine the best vehicle for your child’s education savings.

Important information:

1 Hanson, Melanie. “How Do People Pay for College?” EducationData.org, April 23, 2022,

2 Sallie Mae How America Pays for College 2023

3 College Board, "Trends in College Pricing and Student Aid 2023